Sugar Rush - Why The Economy Will Run Hot, Then Crash

Summary

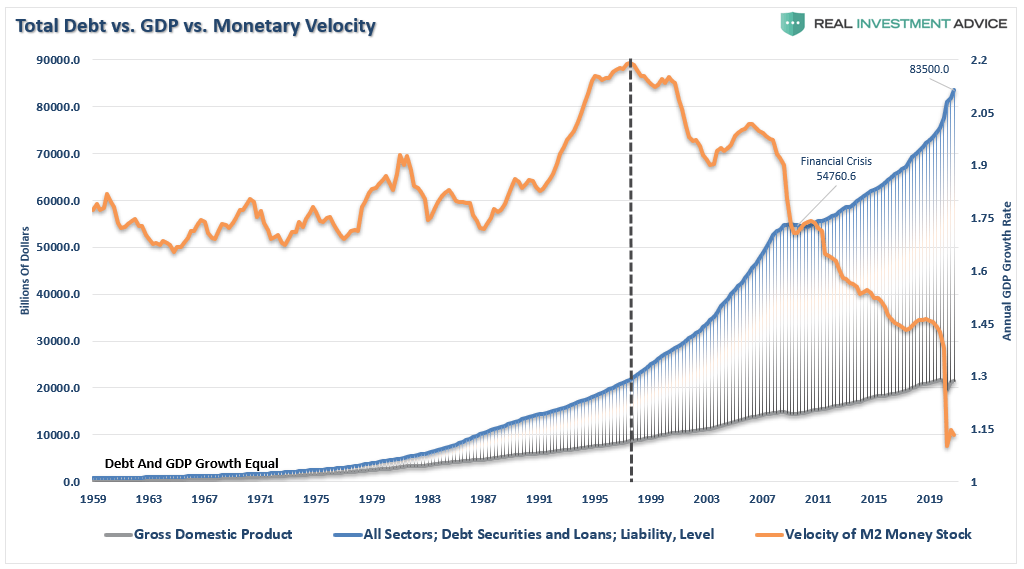

- The expected "sugar rush" from more stimulus is why the economy will "run hot" then crash.

- The vast majority of the growth in the U.S. over the last decade was due to a variety of artificial inputs which are not indefinitely sustainable.

- There is a massive disconnect between the "stock market" and the "real economy."

The expected "sugar rush" from more stimulus is why the economy will "run hot" then crash. As every parent knows, giving a child too much "sugar" leads to a "rush" of energy. Then comes the crash, where you find them in some odd place taking a nap.

The Coming Economic "Rush"

Recently, JPMorgan joined the rest of the Wall Street banks in predicting a surge in economic activity for 2021 of 6.4%. Of course, the entire reasoning behind the rise in activity was due to "stimulus."

"In a note to clients, JPM's chief economist Michael Feroli made the following forecast revisions:

We now look for a $1.7 trillion fiscal stimulus package (up from $900 billion) to be passed in March

Even before that kicks in, growth appears to be on firmer footing at the start of the year

All told we now expect 6.4% (4Q/4Q) GDP growth this year and 2.8% next year

We see the labor market getting back to full employment, or around 4% unemployment, by 2Q22 and expect core PCE inflation to reach 2.0% by 4Q22, with balanced risks around the outlook.

While the outlooks for growth and inflation are moving up, Fed rhetoric appears to be getting more dovish" - Zerohedge

Full article at: Sugar Rush - Why The Economy Will Run Hot, Then Crash | Seeking Alpha